Get the free sar 7 form

Show details

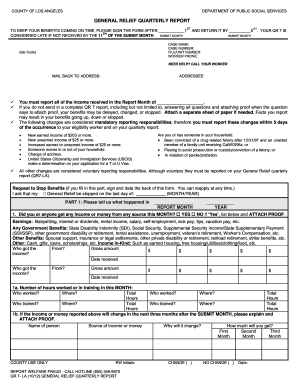

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES CALIFORNIA DEPARTMENT OF HEALTH CARE SERVICES STATE OF CALIFORNIA HEALTH AND HUMAN SERVICES AGENCY SAR 7 REPORT SORE LA SITU ACI N EN REL ACI N À la ELEGIBILIDAD

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sar 7 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sar 7 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sar 7 form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sar 7 online form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out sar 7 form

01

Start by gathering all the necessary information and documents required to fill out the SAR 7 form. This may include income statements, employment records, identification documents, and any other relevant paperwork.

02

Begin the form by carefully reading all the instructions provided. Make sure you understand the purpose of each section and the information that needs to be provided.

03

Fill out the personal information section accurately, including your name, address, contact details, and any other required personal details.

04

Proceed to the income section, where you will need to report all sources of income, including employment, self-employment, rental income, and government assistance. Provide accurate figures for each source and follow any specific guidelines or calculations mentioned.

05

If you or anyone in your household receive non-cash benefits such as food stamps or Medical, disclose this information in the appropriate section. Be sure to include any changes in these benefits since your last filing.

06

Next, declare any changes in your household composition since the last filing. This may include adding or removing members, changes in marital status, or dependents leaving or joining the household.

07

Provide any details about medical expenses that qualify for deduction or exemption and follow the instructions to correctly report them.

08

Complete the form by reviewing all the information you have provided. Ensure that everything is accurate and complete.

Who needs SAR 7 form?

01

Individuals or households who receive CalFresh (formerly known as food stamps), cash aid, or Medi-Cal benefits from the state of California may be required to fill out the SAR 7 form.

02

It is necessary for individuals or households who receive these benefits to complete the SAR 7 form in order to update their eligibility status and report any changes in income, household composition, or other relevant factors.

03

The SAR 7 form helps the state of California determine if individuals or households are still eligible for benefits and if any adjustments need to be made based on the information provided.

Fill sar 7 form online : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sar 7 form?

SAR 7 Form is a form used by the Indian Customs to report the movement of goods across the Indian customs border. It is a mandatory form for export and import of goods in India and is used by the Indian Customs to track and monitor the movement of goods.

How to fill out sar 7 form?

1. The first step is to fill out the basic information on the form, including the applicant's name, address, phone number, and Social Security number.

2. The next section asks for information about the incident for which the individual is filing the SAR 7 form. This includes the date of the incident, the type of incident, the location of the incident, and any other pertinent information.

3. Next, the individual should provide a full description of the incident. This includes the facts of the incident, any witnesses, and any evidence that was collected.

4. Once the description is complete, the individual should then sign and date the form. The form should then be submitted to the appropriate law enforcement agency.

What information must be reported on sar 7 form?

The SAR 7 form requires the following information:

1. Name, address, and telephone number of the suspicious activity reporter.

2. Name, address, and telephone number of the subject of the suspicious activity report.

3. Date of the suspicious activity.

4. Location of the suspicious activity.

5. Description of the suspicious activity, including the names of any individuals or entities involved.

6. Amount of funds or other assets involved, if any.

7. Reason for suspicion.

8. Source of the information, including the name and contact information of the person who provided the information, if known.

9. Whether the suspicious activity has been reported to any other law enforcement or regulatory agencies.

10. Whether the suspicious activity has been reported to FinCEN or another U.S. government agency.

11. Any other relevant information, including documentation or other evidence.

When is the deadline to file sar 7 form in 2023?

The deadline to file the SAR 7 form in 2023 is July 31st.

What is the penalty for the late filing of sar 7 form?

The penalty for late filing of a SAR 7 form is a fine of up to Rs. 10,000. Additionally, the income tax authorities may take other measures such as disallowing expenses and preventing the taxpayer from claiming certain deductions.

How can I modify sar 7 form without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your sar 7 online form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send sar 7 for eSignature?

Once your sar 7 calfresh online is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute how to fill out sar 7 form for calfresh online online?

pdfFiller has made filling out and eSigning sar 7 form pdf easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Fill out your sar 7 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sar 7 is not the form you're looking for?Search for another form here.

Keywords relevant to sar7 form

Related to fill out sar 7 online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.